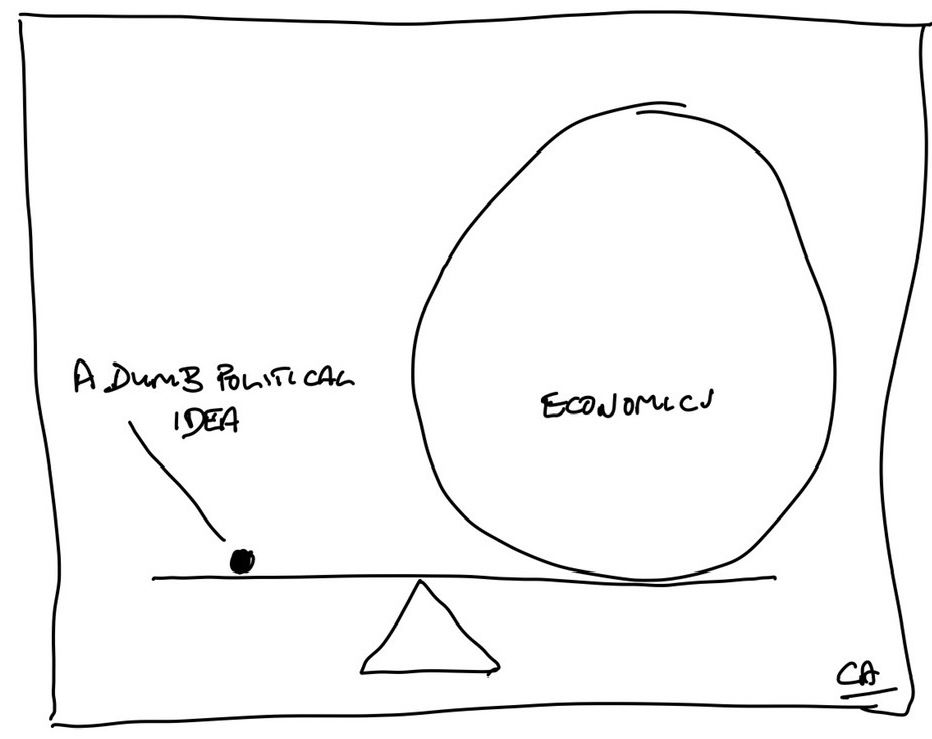

If you’re feeling inundated by headlines of one financial crisis after another—often sparked by questionable motivations or a lack of understanding—we offer you a moment of clarity and calm. Investing isn’t a “set and forget” game—it’s a process of discipline and adaptation. At Citywide, we keep questioning what works and why, scanning the research to ensure the portfolios we build are grounded in what delivers. One core belief hasn’t wavered: markets are efficient, and trying to outguess them is a costly bet. The numbers keep backing this up—over 20 years, up to 98% of active managers have underperformed simple market-tracking strategies.

Instead of guessing winners, we build portfolios that work with the market, not against it—globally diversified, low-cost, and systematically rebalanced. These portfolios don’t just make theoretical sense; they’ve outpaced the majority of multi-asset funds in practice. While hundreds of funds have quietly disappeared, our market-led approach has delivered consistent, real-world results. Tempting as it may be to time the market or run for cover during uncertainty, that instinct often backfires. Markets dip. That’s built into the plan. As Paul Samuelson, famous economist and Nobel Laureate once said, investing should feel like watching paint dry. It’s not flashy—but over time, it works. And for now, it remains the smartest shot at long-term success.

Categories: News