There’s an old line that says markets climb a wall of worry. In 2025, they’ve been mountaineers. If you were reading headlines alone—“Trump ignites trade war!” or “Inflation stubbornly lingers!”—you’d be forgiven for thinking the financial world had spun off its axis. And yet, the S&P 500 has quietly clawed its way back to even for the year, shaking off a 15% freefall with the kind of muscle memory that can only come from decades of surviving worse.

There’s an old line that says markets climb a wall of worry. In 2025, they’ve been mountaineers. If you were reading headlines alone—“Trump ignites trade war!” or “Inflation stubbornly lingers!”—you’d be forgiven for thinking the financial world had spun off its axis. And yet, the S&P 500 has quietly clawed its way back to even for the year, shaking off a 15% freefall with the kind of muscle memory that can only come from decades of surviving worse.

The drama kicked off in April, when President Trump rolled out what he called “Liberation Day” tariffs—massive levies on Chinese goods that triggered a mass exodus from US stocks. The S&P fell 12% in just four days, the kind of plunge that tends to leave scars. But then something strange happened. Retail investors—those same folks who used to be derided as lemmings—rushed in. Five billion dollars in a single day, scooping up everything from Nvidia to index-tracking ETFs.

It wasn’t just a case of misplaced optimism. This wave of buying was tactical, even savvy. Where institutional money managers were pulling out to meet risk limits and performance metrics, everyday investors were leaning in. Call it the Reddit effect, call it the Robinhood generation, but it’s real. And when a rebound finally came—fuelled by Trump’s unexpected tariff truce and better-than-expected inflation numbers—those same dip-buyers looked less like gamblers and more like prophets.

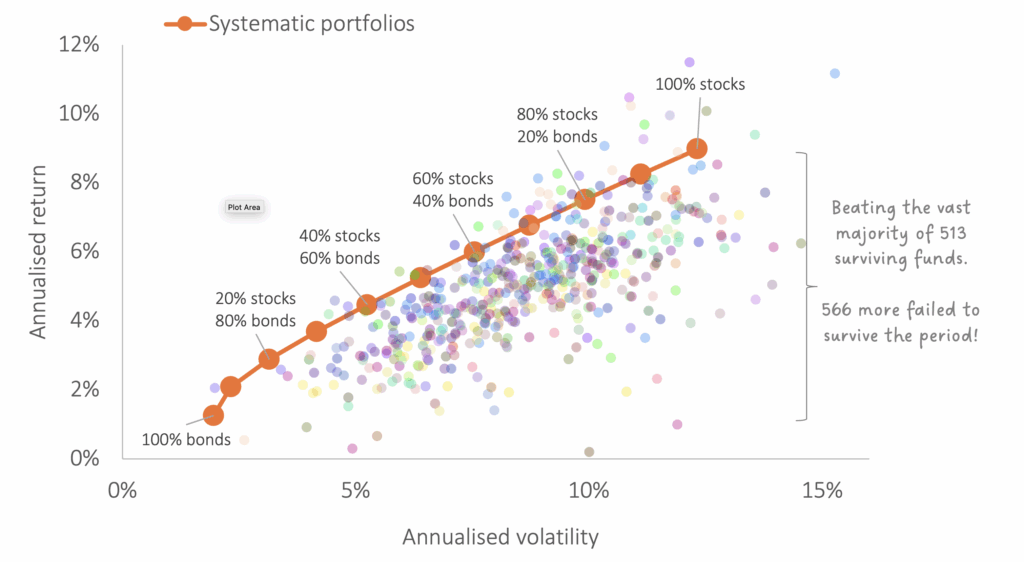

Of course, markets don’t always behave like polite guests at a dinner party. They’re volatile, moody, and prone to bouts of euphoria and panic. But they are also resilient. That’s the point we often make to our clients: over the long haul, markets reflect all available information and tend to reward patience over panic. Systematic investing—leaning on broad diversification and not trying to outguess the market—beats the majority of active managers over one, five, ten, even twenty years. The chart below shows that systematic portfolios—built with discipline and devoid of guesswork—have consistently outperformed the majority of 513 surviving UK multi-asset funds, most of which relied on market timing and stock picking, with 566 others not even making it to the finish line.

The real story of 2025 isn’t about tariffs or inflation. It’s about a market system that, despite constant political interference, still does its job. Equity prices swung wildly in April, but underneath the noise was a growing acceptance that market structure has changed. Retail investors—armed with better tools, lower fees, and fewer illusions—aren’t going away. They’re not buying the news cycle; they’re buying the dip.

And the institutions are catching on. Goldman Sachs revised its year-end earnings outlook upward after the US-China tariff truce, not because the economy had fundamentally changed, but because the market had already priced in the worst. This is the power of aggregated expectations in action—the invisible hand with a smartphone.

None of this means we’re out of the woods. The US’s 30% tariff on Chinese imports still looms after Trump’s initial salvo of 145%. Global growth isn’t exactly humming. And real estate and healthcare stocks are lagging badly. But the market—like a seasoned boxer—knows how to take a punch and keep fighting. Even the harshest critics, like BCA Research, admit that while the economic impact of trade tensions is real, investor sentiment has evolved to adapt to policy shocks, not collapse under them.

What’s happening now is less about fundamentals and more about behaviour. Investors—especially retail ones—are learning to distinguish between noise and signal. They’ve seen that overreaction can be opportunity. They’ve internalised that the best days often come after the worst weeks. And they’re not waiting for permission to make their move.

Which brings us to the real takeaway: markets don’t thrive on sentiment alone—they’re powered by economic fundamentals that tend to outlast even the loudest political theatrics. Investors have started to internalise a critical truth: sound economics, not short-term political noise, drives long-term outcomes. The market’s resilience isn’t about blind faith—it’s about recognising that real-world business activity, innovation, and global demand have more staying power than policy posturing or populist gimmicks.

In 2025, we’ve seen this play out in real time. Tariffs may rattle confidence, tweets may shake headlines, but the economic engine keeps running. It’s a reminder that for all the chaos politicians can create, markets still put their faith in earnings, productivity, and the rational decisions of millions of participants. That’s not idealism—it’s history. And it’s why, despite the noise, markets continue to move forward.

Sources

- George Steer, Will Schmitt, Ian Smith, “S&P 500 wipes out 2025 losses as stocks extend rally” Financial Times, (London, 13 May 2025)

- Editorial Team, “Buy the dip: the trend that keeps stocks from crashing” The Economist, (London, 06 May 2025)

- Data from Albion Strategic Consulting © Multi-manager Comparison Tool. Data to 31/03/2024.

Categories: Financial Planning, Investments, Lifestyle, News